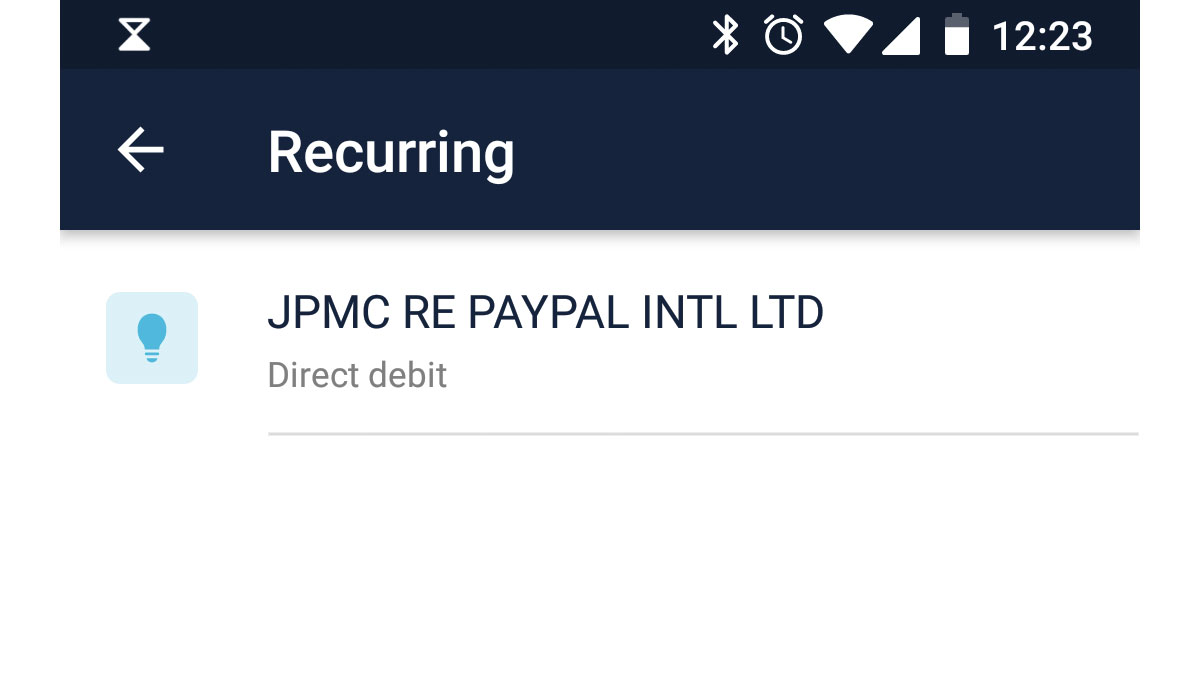

Direct debits are a common method of setting up automatic withdrawals from a bank account for various transactions and services. One term that you might come across on your bank statement in relation to these debits is “JPMC re PayPal Intl Ltd.” This reference can be puzzling, leading to questions about its meaning and its relation to financial transactions. Here’s what you need to know.

What Does JPMC Stand For?

JPMC stands for JPMorgan Chase & Co., one of the largest banks in the United States and a major player in the global financial sector. They offer a variety of banking services, including credit and debit card issuance, payment processing, and direct debits.

Connection with PayPal International Ltd

PayPal International Ltd is a subsidiary of PayPal Holdings, Inc., a leading online payment system that allows users to send and receive money electronically. When you see “JPMC re PayPal Intl Ltd” on your bank statement, it typically indicates that JPMorgan Chase is processing a direct debit transaction on behalf of PayPal.

Why You See This on Your Statement

If you have set up automatic payments through PayPal, such as recurring subscriptions or bill payments, JPMorgan Chase processes these transactions on behalf of PayPal. This might include payments for online services, charitable donations, or even e-commerce purchases.

Is It Safe?

The appearance of “JPMC re PayPal Intl Ltd” on your direct debit list is generally safe. It is a routine indication that JPMorgan Chase, acting as a payment processor, is handling a PayPal transaction. However, if you notice a transaction that you didn’t authorize or recognize, you should immediately contact your bank or PayPal to investigate and take appropriate action.

What To Do If You Have Concerns

If you have questions about a specific direct debit labeled with “JPMC re PayPal Intl Ltd,” you can:

- Check your recent PayPal activity to see if it matches the transaction.

- Contact your bank’s customer service for more information.

- Reach out to PayPal support to inquire about recent transactions or to report unauthorized activity.